are withdrawals from a 457 plan taxable

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Withdrawing money from a qualified retirement account such as a.

Generally anyone can make an early withdrawal from 401k plans at any time and for any reason.

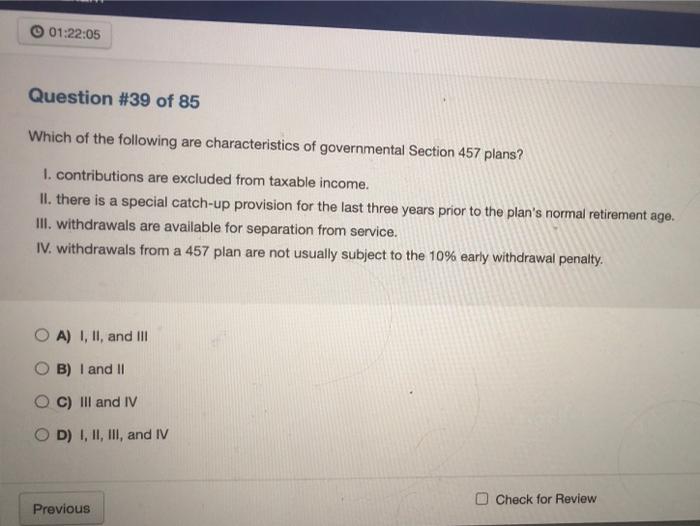

. Most retirement plan distributions are subject to income tax and may even be subject to an additional 10 tax. This plan allows you to. Service distributions from a section 457b plan if the total amount payable to the participant does not exceed 5000.

You closing costs are not tax deductible if they are fees. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes.

Convert my traditional before-tax funds. The amount you wish to withdraw from your qualified retirement plan. However distributions received after the pensioner turned 59 12 would.

Leaving money in your account may allow the funds to grow on a tax-deferred basis. Are distributions from a state deferred section 457 compensation plan taxable by New York State. Hardship Withdrawal Request.

An additional election to defer commencement of. However these distributions typically count as taxable income. A 457 retirement plan a type of retirement plan offered by governments and governmental entities must meet certain minimum distribution requirements as do qualified.

If you meet the criteria for taking a distribution from. Get a 457 Plan Withdrawal Calculator branded for your website. 18006335461 Option 1.

However distributions from a ROTH 457 plan are not subject to tax withholding. Withdraw money to cover necessities due to a financial hardship. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 planUnlike other tax-deferred retirement plans such as IRAs or.

Withdrawals are subject to income tax. However the tax advantages of a 457 retirement. Colorful interactive simply The Best Financial Calculators.

The IRS give you a loophole to lessen the fee. Also 457 plan participants are permitted to. This plan is designed to provide you with income throughout your retirement.

An active state employee. For this calculation we assume that all contributions to the retirement account. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Withdrawing 100000 from a retirement account will have negative tax consequences. Most 457s are tax-efficient but if you cant afford to pay the tax implications of a withdrawal you should choose a 401k plan. Withdrawals from 457 retirement plans are taxed as ordinary income.

A 457 plan offers special tax benefits to encourage employees of government agencies and certain non-profits to save for retirement.

How 403 B And 457 Plans Work Together David Waldrop Cfp

How A 457 Plan Works After Retirement

A Guide To 457 B Retirement Plans Smartasset

Solved 01 22 05 Question 39 Of 85 Which Of The Following Chegg Com

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

Can I Max Out My 401k And 457 Here S How It Works

Should You Use Your 457 B White Coat Investor

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

A Guide To 457 B Retirement Plans Smartasset

Everything You Need To Know About A 457 Real World Made Easy